This guide will help you develop the ultimate landlord business plan from scratch. Like any business, it is essential to understand the micro and macro environment, your competition, your property strengths, weaknesses and opportunities. The simple act of putting pen to paper will help you structure your plan so you have clear goals, objectives and KPIs (Key Performance Indicators) which will help to dramatically increase your real estate investment’s success.

The Landlord Business Pitch

Lets say you wanted to raise money for your new real estate investment opportunity and you wanted to pitch some investors. What would be the best way to structure the pitch deck? It is always better to keep it simple. Here are 10 slides you should have within the pitch deck

- Your Company Name (Who are you)

- Your Real Estate Vision

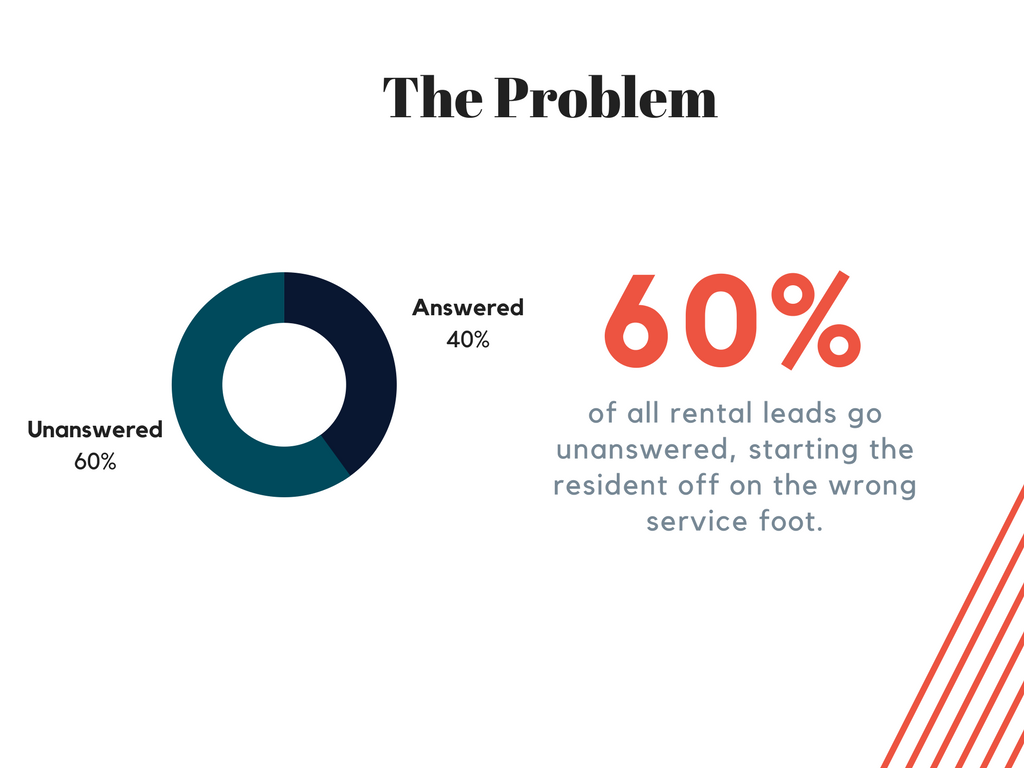

- The Rental Problem

- Your Rental Solution

- The Real Estate Investment Opportunity

- Local Rental Market Data

- Local Competition

- Your Rental Marketing Plan

- Your Rental Operations Plan

- Thank you

Now, most real estate investors may have less than 5 properties, however, even if you are not going to raise money, it is still a good idea to do your own pitch deck to help organize your differentiator and strategy.

Here is an example landlord pitch deck below:

Lets dive deeper into an individual landlord business plan and strategy now that we have a good base.

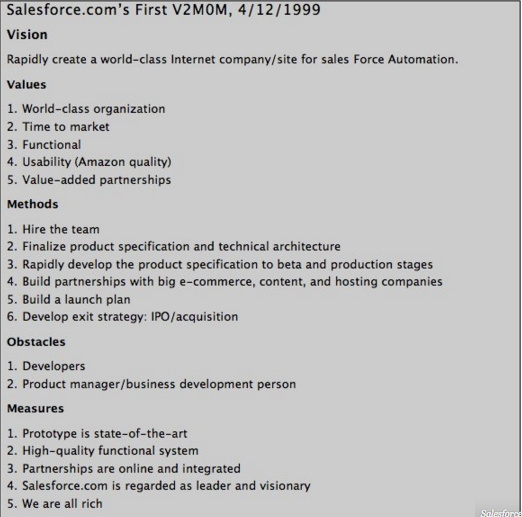

An individual business plan will be based on your own needs and wants. The CEO of SalesForce.com, Marc Benioff, developed a simple strategy to get his entire organization aligned. He calls it the V2MOM. It is structured as follows:

Vision

(What do you want?)

Example:

Rapidly create passive cash flow through service oriented real estate investments; giving me the freedom to travel the world with my family, anytime we want.

Values

(What’s important about your vision)

Example:

- Quick to market

- Data Driven

- Resident First Approach

- Automated Service

Methods

(How do you get it?)

Example:

- Develop investment acquisition plan

- Determine best way to finance properties

- Build partnerships with leading landlord software providers

- Develop list of properties that meet my investment criteria

- Be 100% in the cloud

Obstacles

(What might stand in the way?)

Example:

- Not enough cash in the bank

- Don’t have time to manage property

- Don’t know how to manage properties

Measures

(How will you know when you have it?)

Example:

- Over $10K a month in net positive cash flow

- Traveling the World

Below is the first V2MOM that Salesforce did in 1999. Wow, have the come a long way.