If you are purchasing rental properties without the use of a real estate investment calculator, you may be leaving a lot of potential rental income and rental profit on the table. As a landlord buying investment property, you should be able to answer a few questions. What is your cap rate? What is your internal rate of return? Is your IRR too low? What about your cap rate? Is that too low too? You can answer all of these questions with simple calculations based on the rental and financial data you collect. Below are a few free real estate investment calculators you can use to maker better rental investment decisions.

Real Estate Investment Calculator

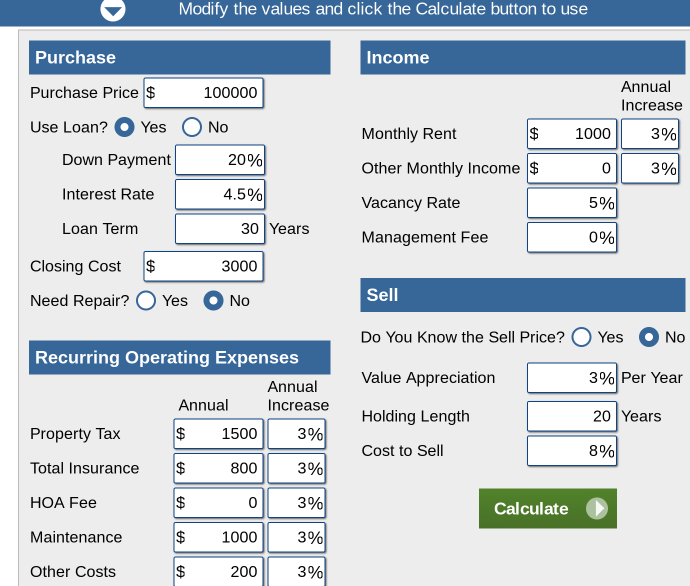

This free investment calculator below can help generate calculations on IRR (Internal Rate of Return), total profit when sold, cap rate, first year rental income and expenses and much more. You can use this calculator and gain 95% of all the calculations that you would need to make a more informed real estate investing decision.

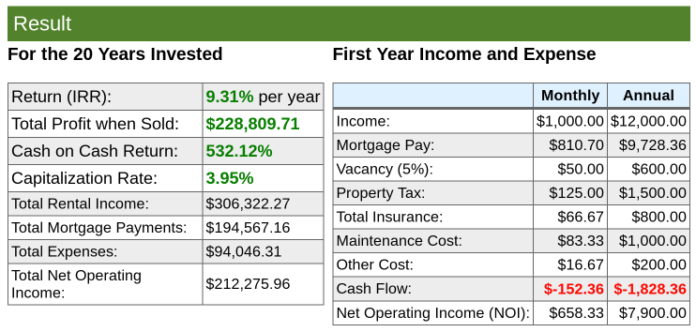

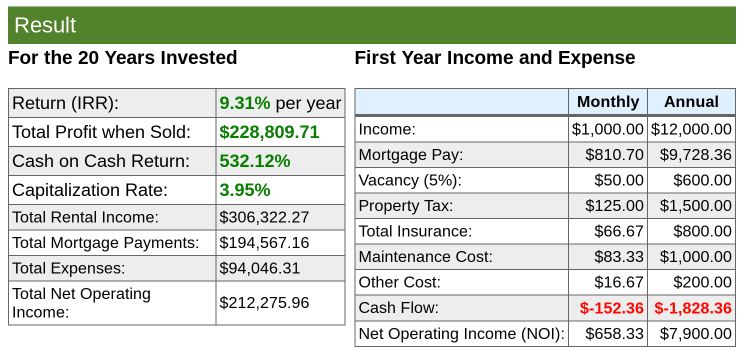

Results would look something like this based on the investment data entered.

Another free real estate investment calculator can be found below from AARP. This is also extremely robust and will show you calculations on net operating income, annual debt service, cash flow, ROI with appreciation, cap rate, debt ratios and more.

These web based apps can take the pain out of crunching these numbers in excel. However, if you prefer excel you can use this google docs sheet for real estate analysis. Simply make a copy of it within Google docs and start to add your own data.

At the end of the day, what gets measured, improves. This also means that when you quantify your real estate investment even before cutting a check, you can use data to make much better investment decisions that will hopefully make real estate investing more fun and less stressful.