What role does new technology play in real estate? Well, given that just in the brokerage and management space, the market generated over $200 billion in revenues in 2016, there is no doubt that large and small corporations alike, in addition to individual contributors, are leveraging technology to help with efficiency and profits.

Here are 4 technologies being utilized in the real estate space that you may find interesting:

- Drones. The use of drone technology has been helping with marketing for years. It’s quite simple really – A drone equipped with a camera is sent up in the air and photographs what would otherwise be difficult and/or expensive photos of a property. This is typically used in the ‘For Sale’ space and can help agents separate themselves from the others in an intensely competitive market where there are not too many differentiators. In the photography space, it will not be long before this becomes an industry standard. Speaking of drone photography, some groups are going the extra mile and incorporating video into the aerial footage that a drone captures which is especially useful for large properties with a good deal of s

quare footage. An interesting trend in drone technology is utilization in the insurance space as well. This is gaining steam as it is less risky and often times more comprehensive when compared to having an insurance adjustor climb onto a roof to assess damage from a storm. This is extremely helpful as it allows claims adjustors spend more time on processing the claim as opposed to determining how to get on and off a roof, not to mention the reduction in liability in case an adjustor takes a spill.

quare footage. An interesting trend in drone technology is utilization in the insurance space as well. This is gaining steam as it is less risky and often times more comprehensive when compared to having an insurance adjustor climb onto a roof to assess damage from a storm. This is extremely helpful as it allows claims adjustors spend more time on processing the claim as opposed to determining how to get on and off a roof, not to mention the reduction in liability in case an adjustor takes a spill.

- Virtual Reality (VR) & 3D Technology. We have been seeing 3D floorplans for quite some time in the real estate space, both in ‘For Sale’ and ‘For Rent’. Matterport has recently enabled technology that transitions their 3D technology into VR which is pretty cool. Why do this? The same reason we transitioned from text newspaper ads to online, digital photography – The technology offers a better user experience by arming the prospect with more information and knowledge about the property. This is good for the prospect but just as important for advertiser as it better qualifies the opportunity. The implementation of VR/3D is giving the prospect a more well rounded (pun intended) tour of the property. This is great for folks who are short on time, especially when buying or renting in a long distance capacity. This technology is improving conversion rates in multifamily leasing, residential renting and even providing stories in which investors are buying properties sight unseen (at least in person).

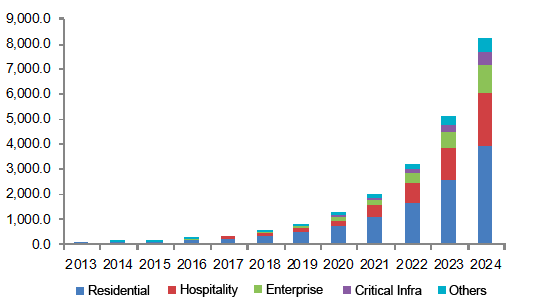

- Smart Home Technology. This technology has been around for quite some time, but always had obstacles that prevented widespread adoption; mainly cost and device reliability. With costs coming down dramatically and major tech players devoting billions to IoT devices (Internet of Things), these products are now fairly mainstream. Yes, the Nest still has a hefty price and is not anywhere close to being an industry standard, but it has opened up the door for other providers to develop more cost friendly smart thermostats.

While smart home technology had traditionally been utilized as a security system for residential homeowners, there are many other ways smart devices are being adopted into real estate.

Access control. According to Grand View Research, smart locks carried a market size of over $400 million in the U.S. in 2015. This number is going to explode in the next several years as keyless entry is not just offering an alternative way to access a property; it is now being relied upon to run a business. Short term rentals have never been more popular with the rise of AirBnB and many short term rental landlords or vacation managers rely on smart locks to provide access to their guests. Have you checked into a hotel lately? When was the last time you received a physical key? Sure, keycards have been more the norm over the last decade, but even those are going away. The last time I stayed in a hotel, which was earlier this year, I was given the option to access my room with my smart phone. Done deal as I am famous for leaving my keycard in the room, or losing it at the pool or gym. This technology is also becoming more popular to track entry for self showings in both the ‘For Sale’ and ‘For Rent’ space. Temperature control is also becoming more and more popular as the cost savings opportunities are being met with favorable data that is forcing companies and individual owners alike to con

sider the technology. This is the key to adoption as it is becoming more of a need as opposed to a “nice to have” and if there is money to saved by setting a thermostat in a cost savings mode when a room or home is not populated, then it makes a lot of sense to deploy the technology. This is also extremely practical when it comes to risk mitigation as users can put “if this, then that” (IFTT) practices in place to ensure a thermostat does not go above or below a certain temperature which is handy during the combination of vacancy and freezing temperatures as it prevents pipe ruptures.

sider the technology. This is the key to adoption as it is becoming more of a need as opposed to a “nice to have” and if there is money to saved by setting a thermostat in a cost savings mode when a room or home is not populated, then it makes a lot of sense to deploy the technology. This is also extremely practical when it comes to risk mitigation as users can put “if this, then that” (IFTT) practices in place to ensure a thermostat does not go above or below a certain temperature which is handy during the combination of vacancy and freezing temperatures as it prevents pipe ruptures.

- Discount Brokerages. Some would argue that the massive amount of data that is now available to consumers has reduced the value of traditional real estate pricing models. Who wants to pay 3%-5% in a transaction? No one, but this is a personal choice as the cost of a broken deal can result in even higher costs. Regardless of preference, the discount model is proving itself with groups like Redfin disrupting the space in which 3% to 5% used to be the norm. Personally, I have done both and in my experience, the discount broker got the job done once, and failed drastically on another transaction. What was interesting is that when utilizing a flat fee broker here in Denver, I immediately began receiving feedback that other agents may not show the property because it was not worth their time. “Really?!?”, I thought…how can agent, who is obligated to serve their clients best interest NOT show them a property because of the brokerage I was using, especially when at the time, the supply in the market was extremely limited. Well, I can tell you that it happened and I was not pleased. Rather than the market disruptors forcing the intended change of driving commission costs down, a few bad apples in the space took a stand and prevented a deal from happening. I suppose this is what happens when resistance meets the opposition that could disrupt their space. For the record, I trust that most brokers are doing the right thing for their clients, this was just one experience but I mention it because it lends credence to the fact that discount brokerages probably are not going anywhere as they are making a case that the traditional pricing model is outdated as a result of the public data/analytics that are now available to anyone with an internet connection or smart phone.