Property ownership has been recorded in the form of a deed since before the American Revolution. These legal documents are how one owner of land transfers their claim to that property to someone else.

Then anyone interested in buying that land can look up the owners in a registry. This system helps prevent would be fraudsters from claiming ownership to land they have no right to.

Sometimes though, you aren’t selling your land, you just want to give or transfer the ownership rights to someone else. You don’t need to go through the whole complicated process of a land sale agreement and contract.

We are going to walk you through determining if a quit claim deed is right for you, what you need to know, and how to fill out your legal document.

1. Know What a Quit Claim Deed Is

To transfer property to someone else you need to use a deed. There are different types of deeds though, one of which is a quitclaim.

It is different from other deeds because you make no guarantees with your transfer. There is no promise or warranty about your supposed interest in the property.

If you want a warranty or promise with your deed then you need to look at a general warranty or special warranty deed. Both of these provide a certain level of protection and warranty.

This means that the owner of the property could be transferring nothing if it turns out they had no real interest in the property.

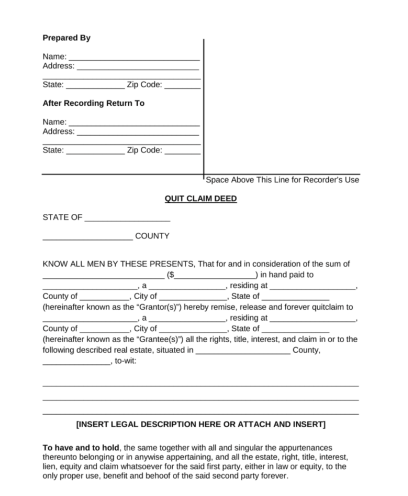

Free Quit Claim Deed in Word

2. Does It Fit Your Use?

This type of deed is usually used when a family member is transferring their ownership to another family member. In this type of transfer, there is no concern of the legitimacy of the claim of ownership.

Divorce or Marriage

Another common time of use is during divorce. One party can transfer all of their interest in the family home to the other party.

In this same train of thought, if a couple has recently gotten married, one spouse may want to give ownership rights to their new spouse. In this transfer, one spouse would transfer half of their interest to the other.

Tax Seizure

They might also be used when a property is seized and sold at auction due to unpaid taxes. The state will transfer whatever ownership interest is seized.

The profit from the sale will go to pay off the tax debt. Any leftover money will go to the original owner the property was seized from.

Speaking of taxes, any tax liabilities should be addressed and paid before you issue a quit claim deed. According to tax law, property taxes are the responsibility of the owner.

So if the grantor owes back taxes, those back taxes will become the responsibility of the grantee. The grantee may be unknowingly agreeing to accept a large debt.

Gifts

If you want to move your ownership of the property into a trust then a quitclaim deed is useful for this. It also works well as a method for gifting the property to someone.

Making Corrections

Mistakes happen, and sometimes the party’s information is not filled out correctly on the original documents. This can be a problem later on when you go to sell the property.

A quitclaim deed can fix this by being the method for correcting the information. A common corrected error would be someone’s name being misspelled.

Another common reason to make corrections is that your title insurance company requests it. If you are trying to sell your home, and there is a defect in title, the insurance company won’t want to insure the property.

A quitclaim deed will help clear up these clouds. Then you can insurance the property and move forward with your sale.

3. Types of Ownership You Can Transfer

When you will out a quitclaim deed you are only transferring your level of interest in the property. This doesn’t necessarily mean you own the entire property on your own.

If you do happen to be the only owner of the property then you own it in fee simple. You will transfer the entire ownership interest.

Joint tenancy ownership means that at least two people have an ownership interest with right of survivorship. A right of survivorship is where the other owners will inherit additional ownership upon the death of one of the owners.

The owners have no right to sell their interest though. If you transfer this interest your joint tenancy interest turns into a tenancy in common.

Tenancy in common is when two or more people have an ownership interest in the property. There is no right of survivorship, but the owners are free to sell their interest.

A final time of ownership is a tenancy in the entirety. This type of ownership only occurs when a husband and wife own property together. When one spouse transfers their interest to the other then the interest turns into a fee simple.

4. The information you Need to Gather

Before we get into the details of filling out a quitclaim form, we should mention that each state has their own laws for what is required. While filling out a standard form is useful, you should check with your state’s requirements.

Here are some of the basic requirements that most states include:

- Names of both parties

- Name of county where the property is located

- Property address

- the legal description of the property location

- date of interest transfer

- contact information for the party responsible for the taxes

- both party’s signatures

- notarization of the signatures

5. Know the Terms Used

There are a few terms that you may see and should be familiar with. This will help you read through and fill out the form more easily.

Grantor

This is the person who has the ownership interest in the property. They are granting or giving their interest.

Grantee

This is the person will receive the ownership interest. They are being granted or given the interest.

Jurisdiction

You need to know the jurisdiction where the land is located. This is the governing body over the land and by extension, your quit claim deed.

Real Property

Real property is land and anything attached to that land. This could be buildings or any other structure.

Easement

An easement is a right someone has to use a portion of the land. They usually give access to something like a fishing pond, or an access road.

The grantor can retain easement rights for themselves. If there is already an easement, the grantee will need to comply with it.

Encumbrance

If there are any encumbrances on the property that the grantor knows of, you will want to include these. This could be a lien or deed restriction.

6. Download and Fill out Your Template

Now that you understand the terms and know that this is the deed you need, you need to find a template. There are many template options online, but your easiest option is to download one and fill it out in Word.

Open the word doc and fill out the template. It will typically have the party’s information at the top.

Then the details of the agreement in the body of the text. At the bottom of the document will be where you sign and have it notarized. Be sure to wait to sign it until you are in front of the notary.

7. File with the Clerk of Court

It isn’t enough to fill out a quit claim form and have it signed. The fully executed document needs to be filed with the county recorder or court clerk where the property is located.

This will effectively put everyone on notice of the ownership change.

8. Consequences of Not Using a Quit Claim Deed

Without this deed, the grantee cannot record their ownership with the clerk of court. They also can’t prove their right of ownership in the property.

Filing with the clerk doesn’t automatically mean you have the superior claim of title over everyone else. But what it does mean is everyone else is on notice of your claim.

Anyone that tries to buy the property after you will have a claim that is junior to yours. Any title search will include your quit claim deed.

Prepare Your Quitclaim Deed

If you need to do a quick transfer of ownership interest or correct the information on a previous deed, you don’t need to go through the expense of hiring an attorney. You can fill out a quit claim deed template and file it yourself.

Just make sure the person you are giving the property to knows that this type of deed doesn’t come with any guarantees or warranties. So if it turns out you don’t own the property, then they don’t either.

Finally, make sure you check with the jurisdiction where the property is located for the exact requirements. You don’t want your deed to be invalid because you missed including some required information.