Coming this Fall, there are going to be some changes in how credit scores are evaluated which is important to know if you are renting a property, or running a credit check on a prospective tenant.

The change is designed to score credit based on historical trends as opposed to snapshots of credit at the time of a pull. The new scoring system is going to rely on what is called “trended credit data” and will take aim at giving lenders deeper insights into a borrower’s financial habits over time. It is likely that the lenders will go back 30 months and analyze data over a 2 and a half year period to gain a more true understanding of how a borrower utilizes credit.

For example, there was no credit penalty in the past for making minimum payments but that may change with the new system. It is also likely to impact those with very high credit limits on their credit cards as a lender may now view that high limit as a potential risk in that credit can be run up in a financial pinch.

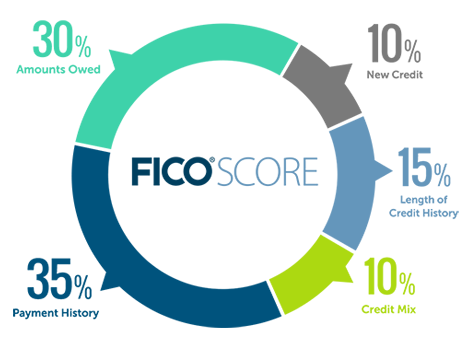

What is important to know is that this scoring change is going to impact a VantageScore, not a FICO score. VantageScores and FICO are utilized by all 3 major credit bureaus (TransUnion, Equifax and Experian). It is more likely that a FICO score will be utilized when applying for a home mortgage, but a VantageScore will be used when applying for an apartment or purchasing a new car.

This is important for those who are going to be renting a property in the near future as they may be misled into thinking their credit profile has gone unchanged, only to be surprised to see that their score has dropped.

What could impact a VantageScore negatively under the new scoring model?

The main driver to the new scoring model appears to be how a consumer is handling his/her credit debt. Keeping your actual credit debt to credit limit ratios under 30% remain important. For example, if you have a $10,000 credit limit, keeping the balance under $3,000 is important. Beyond that however, the score will also take into considering how the debt is being paid down.

The main driver to the new scoring model appears to be how a consumer is handling his/her credit debt. Keeping your actual credit debt to credit limit ratios under 30% remain important. For example, if you have a $10,000 credit limit, keeping the balance under $3,000 is important. Beyond that however, the score will also take into considering how the debt is being paid down.

Keeping up with minimum payments may hurt the score while paying it down in larger payments can help improve the score. From a historical standpoint, the scoring model will take into consideration the last 30 months of debt to determine how debt is accrued and paid. For example, paying off a balance 30 to 60 days before applying for credit may not provide the temporary boost that it used to, especially if it is determined that the a borrower consistently has been carrying debt prior to a credit pull. On the flip side, a major purchase that immediately impacts a credit score (negatively), may no longer hurt the borrower if the their credit history shows that they quickly pay off big purchases.

The consensus overall is that the new scoring model will help provide more access to credit for a larger pool of people especially since civil judgements, tax liens and medical collections will no longer impact the new scoring model.

At the end of the day, paying bills on time and in the full amount while keeping credit card debt from accruing will continue to be a path toward a strong credit score and lower interest rates when it comes time to borrow.