As a real estate investor you may be asking yourself the question, “Should my investment property be utilized as a long term rental, or should I go the short term rental route and use AirBnB?”.

This is a question that you did not have to answer a decade ago as real estate investors were primarily in the business of long term rentals, or perhaps they had a vacation property in which most cases, they turned over the management to a group that specialized in serving that specific vertical.

Nowadays, the shared economy has not only been accepted, but it has been embraced by a large segment of the population and it continues to gain steam. As a result, there may be real estate investors who are now weighing their options as to whether or not they should go down the route of short term rentals, many of which already have.

Before you start seeing AirBnB dollar signs, you should take a step back and analyze a few things prior to taking that plunge.

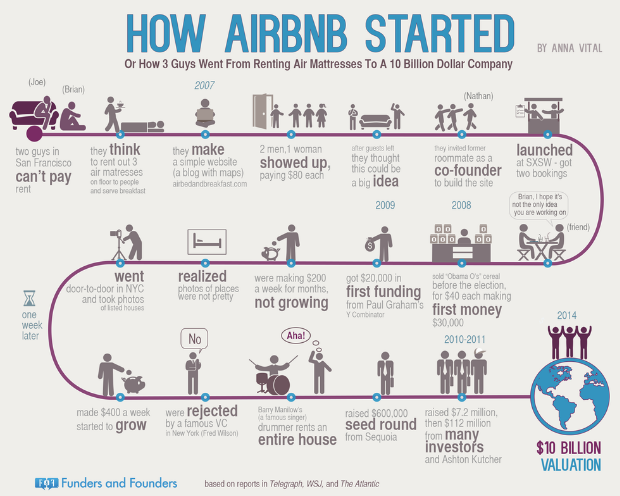

First off, let’s face it; AirBnB is an absolute behemoth as it has scaled quickly and transformed what was once viewed as a risky proposition into a disruptive norm for real estate investors and even homeowners. AirBnB has forecasted that it will earn $3.5 billion by the year 2020 and with over 1 million listings in over 200 countries, it is safe to say that this model is not going anywhere.

These are impressive statistics for a company that was not even around in 2005.

However, this does not mean that everyone is meant to get into the short term rental space.

While the thought of increasing your ROI through a short term rental strategy might be appealing, there are not only financial considerations to be made, but for the self managers out there, they had better brace for a completely different approach to being a landlord.

First, let’s look at some of the financial considerations.

Taxes.

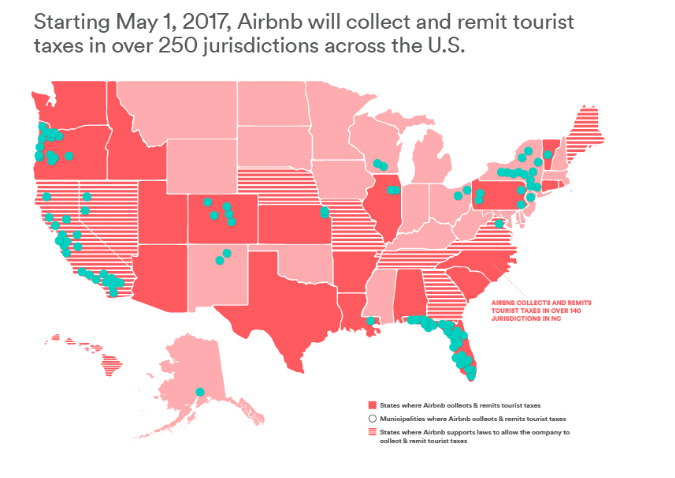

Many state and local jurisdictions have implemented an occupancy tax which was aimed directly at AirBnB users. For instance, in 2015, it was estimated that AirBnB users were responsible for nearly a $2 billion dollar loss to the lodging industry in New York city alone. Not only did this have hotels in an uproar, but there are local, city and state taxes jurisdictions that suffered as a consequence as well. With that in mind, many state and local governments have implemented what is called an “Occupancy Tax” on short term rentals. This is a clever way of collecting a traditional lodging tax, a room tax, a sales tax, a tourist tax, or a hotel tax.

These tax consequences are specific to each location and can vary by country, state, city or even a particular county, so all hosts (landlords) should be aware of what the tax consequences are to their guests, and for themselves.

Here is an image which shows how many jurisdictions in the U.S. alone that will be charging a tourist tax on all AirBnB rentals.

There are other financial considerations to be made when considering the short term rental strategy over the traditional long term route.

Is your property in a market where there will be demand for AirBnB users? While short term rentals are not exclusive to vacationers or tourists, that is not to say that every market is going to friendly to short term rentals.

Have you gone to the AirBnB website to see if there are any properties in and around your location that are listed on AirBnB? If so, how many and what are the asking rents looking like?

Next you will have to consider occupancy. What can you collect in rent with a long term lease versus a short term rental model? Keep in mind, while you may be able to get more on an average nightly basis, the property may not be occupied every night in a given month.

Here’s an example.

Let’s say you can earn $1,000 per month on a long term lease that runs for 12 months. Without factoring maintenance or management costs (to keep this simple), that means you can collect $12,000 in rent over the course of 1 year.

Compare that to an AirBnB. In this example, let’s forecast that you can get $100 per night (not factoring in for seasonality adjustments). That means you would need to ensure that the property is occupied for at least 120 nights during the year to equal the rent potential of a long term rental at $1,000 per month. Again, for the sake of simplicity this is not factoring in the maintenance, management or taxes that factor into the investment.

Speaking of maintenance and management, let’s explore that a bit further.

Any self managing landlord will tell you that managing a rental is not exactly a situation in which you can put the property on auto-pilot while you sit back and relax. Managing rental property on your own is going to take some level of hands on work, even with a long term rental strategy in which the tenant signs a 12 month lease.

A short term rental strategy is going to require a different approach to how you manage the property and will most likely be even more hands on.

Here are a few considerations:

- Consumables. For the short term “guest”, they are going to view this as an alternative to traditional short term lodging (i.e. hotel rooms), but they will have similar needs and demands to that of a traditional hotel room. First and foremost, consumables. Soap, shampoo, dishwasher and laundry detergent, coffee, tea, toilet paper, trash bags, lotion, towels etc. Not only will some of these items magically disappear upon turnover, but these are items that should be factored into your expenses.

- Maintenance. Who is going to re-stock the consumables? Who is going to clean the property? It is likely that you will charge a turnover or cleaning fee to each guest, but do you have anyone who you can rely on to not only stock the house, but to clean the house when a guest checks out? What if you have a tight turnover window in which the previous guest checks out at 11am and a new guest is scheduled to arrive at 3pm; do you have a reliable housecleaner to come in and turn the property around in time for the new arrival? Finding reliable workers is difficult, especially when you are now operating a business in which matters are extremely time sensitive. If a guest walks in while the house is being cleaned, he/she most likely will not be pleased and that could have a significant adverse impact on your score as a host. Consistently getting bad scores as a host is a quick way to be forcefully removed from the short term rental space.

- Management. Have you thought about how are your guests going to access the property, especially if you are managing from a remote location? Do you have software in place to help in this effort? Does the software require and integrate with smart hardware so that you can put a smart lock on the door to manage the arrivals, departures and security of your guests (and the home)? How about the thermostat? Is it smart? If not, you may want to make sure it is as you will want insight into whether or not the AC is running at a low temperature during a vacancy, or to ensure the heater is on when a guest departs to prevent pipes from freezing. This should also be factored into the overall expenses of running a short term rental business.

There is unquestionably a new market to consider for real estate investors and the arrival of AirBnB has transformed the real estate market and disrupted not just the short term space, but is now putting its fingerprints on the long term market as well. Be sure to do your homework as you analyze whether or not this AirBnB play is the right move for your investment.