Rent growth is defined as the percentage of change in rents from one market to the next. If you rent, you probably know at a minimum that the cost to rent has consistently gone up since the Great Recession. The housing market falls, builders stop building and what we had left was tight supply of inventory and high demand of folks looking to rent. Mix that combo together and it’s pretty obvious that rents rise as a result.

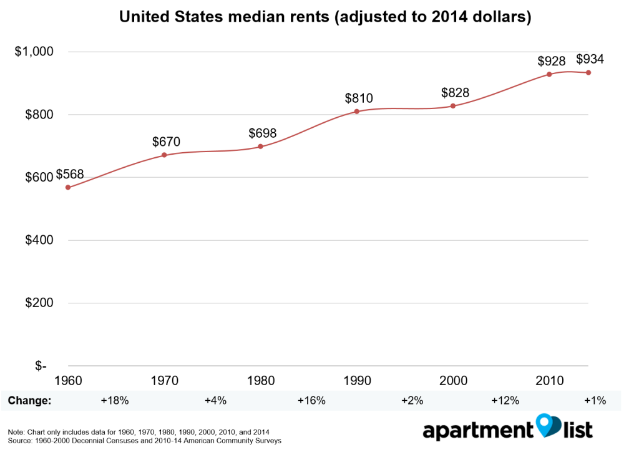

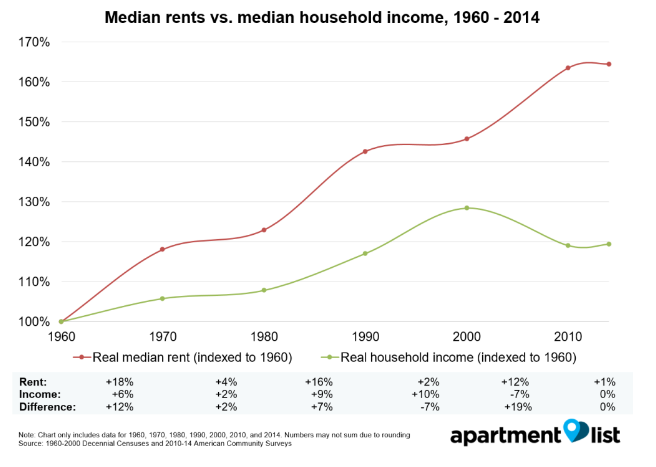

However, if we go even further back in time, we can see that even with inflation adjusted rents, the cost to rent a property has gone up 64% since 1960.

Our good friends at ApartmentList have some fascinating data surrounding rent growth which is illustrated above and below.

While it is clear that the arrow has steadily gone up over the years, and more so within the last 5 to 7 years, there are signs of relief.

For example, according to Trulia, of the metro Denver rentals that have been listed over the last 12 months, 18.5% of them experienced a reduction in asking rent when compared to the initially listed rental amount. That could certainly indicate that some landlords are coming in too high, but it is also likely that the ceiling has been reached and we are starting to see a decline.

We know this because 83 of the top 100 metro areas are experiencing a decline in rental amounts that were listed in the previous 12 months. This should bring some stability to the rental market as landlords are realizing that they are now unable to push rents to the next pricing category.

As a renter, when looking for a property, it is important to compare it to other listings in the immediate and surrounding areas as this will offer a good idea of what the true market rate really is. Once we start to see move in concessions, that is another sign that occupancy needs a boost and rental rates are on the decline.

As more inventory enters the market in single family housing and multifamily construction coming to fruition, there will be more impact on rent growth as it will likely continue to stabilize, if not decline in major metro markets that have been on the high end of the growth cycle over the last half decade.

With a majority of the top metro areas experiencing a decline, it is a sign of more to come when it comes to renters getting a little relief from the consistent increases over the last several years.