According to a poll released by Freddie Mac last month, renters are feeling good about where they live and overall, feel pretty good about the concept of renting as well.

Why is this news? For starters, the concept of the “American Dream” is often tied to land/home ownership. While this remains true for many and continues to be a sound financial investment under the right circumstances, the stigma that was once tied to renting has continued to fade. Reasons may include the continued recovery from the most recent financial and housing fallout in which the aggressive loan options turned many homeowners upside down and unfortunately, generated an unprecedented spike in foreclosures. As a result, credit standards tightened up and despite gains in employment, wage increases have been fairly stagnant. Many of the boomers are retiring while a growing number of millennials hit the market and are deciding what their path is going to be as it relates to housing. Job flexibility is on the rise as this is a growing demand for employees and as a result, there is a growing segment of the population which does not want to be tied to a mortgage should they choose to move and experience another city.

These factors, amongst others, are changing the some of the stereotypes in the real estate landscape.

Here are some of the more interesting data points from the recent Freddie Mac survey:

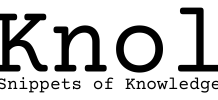

- The number of renters who say that renting is a good choice for them has risen from 46% to 52% just within the last year.

- 41% of renters now state that they have enough money to last beyond their most recent payday. This is up from 34% last September.

- Financial confidence rose for renters in all age groups no matter where they live. The biggest increases were among rural households, up from 27 percent to 46 percent, and baby boomers, up from 38 percent to 48 percent

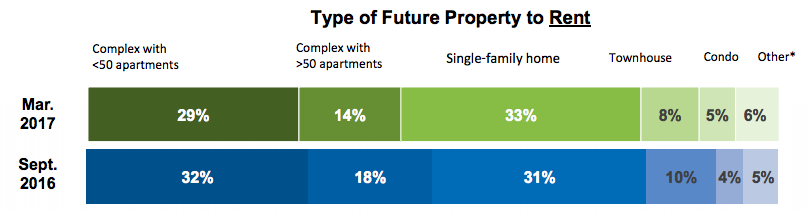

- The number of renters who say they plan to rent their next home rose to 59 percent from 55 percent. The biggest increases were among suburban households, up from 48 percent to 57 percent, and among Millennials (ages 18-34), which rose from 64 percent to 73 percent.

- While homeownership remains on the horizon, the percentage of renters who expect to own fell from 45 percent to 41 percent since the prior survey.

- Similarly, in response to a related question, the number of renters who say they are working toward homeownership fell from 21 percent to 15 percent over the same period.

Most respondents favor urban areas as well with 75% of the renters surveyed stating that they would move into a smaller space if it meant they could move into an urban area of their choice.

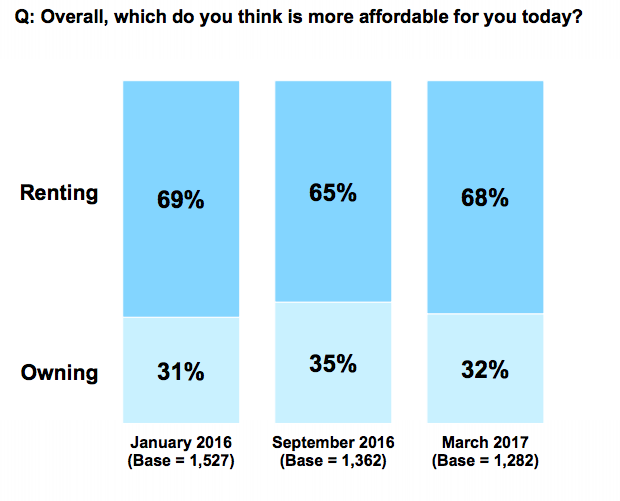

This data is very telling as it represents a mindset that is drifting slightly away from some of the norms. I would contest that once builders crank up inventory in the suburbs, specifically in the starter home product, this data may shift the other way as affordability is keeping many on the sidelines. Rather than fight it, many are clearly embracing it but let’s see what happens when the option to buy/invest presents itself to more of the renting population as that will determine whether this shift in ideology will remain, or if the American Dream continues to be at least partially defined by home ownership.