Renters Insurance has been around for about 70 years. Prior to the 1950’s various insurance policies had to be separated based on different potential accidents that may occur. This was time consuming and expensive. In the years and decades following, insurance companies began to offer products that solved the homeowner and renter challenges that may occur within a dwelling. This process has not changed and has historically been time consuming and a pain to get. With the acceleration of mobile devices and artificial intelligence, getting renters insurance is now as easy as sending a text message.

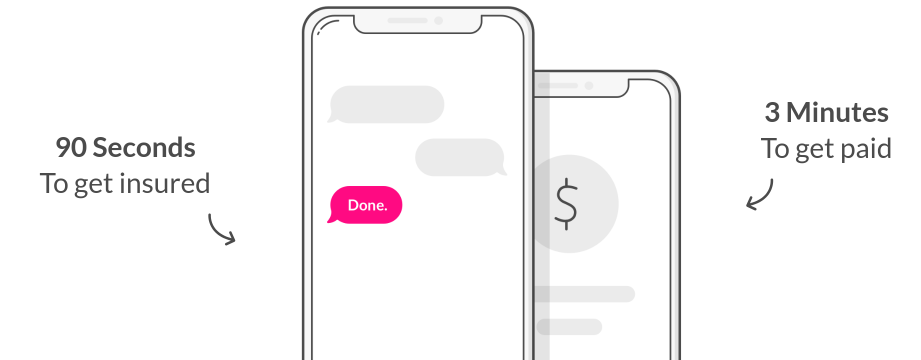

Renters Insurance in 90 Seconds

We ran across a startup that is disrupting the renter insurance market called lemonade. Lemonade offers renters and homeowners insurance for urban dwellers. They have raised $180M in venture funding and have become one of the fastest renter insurance platforms in the world.

Within 90 seconds, renters can get a quote and be insured. Once a claim is made, it takes approximately 3 minutes to receive the funds. The monthly renters insurance price starts at $5 per month and with their Zero Everything service, there are no deductibles or price increases for claims.

What does Renter Insurance Cover?

When living in a rental home or apartment, some landlords make it mandatory for the renter to get renters insurance. The insurance covers the loss, theft or damage of the renter’s personal belongings. It can also cover injuries to another person that might occur within the rental home but this tends to be under liability insurance. In most policies, flooding is not covered within the policy.

How Much Renters Insurance do I Need?

You should get enough renters insurance to cover the value of your personal property. If you live alone, a good starting point is around $10,000. For couples, a good starting point is between $20,000 and $40,000. You can also get additional coverage that can protect you from accidental loss, damage, and theft.

What Should You Get Covered?

Make a list of all of your personal items you would like insured. Taking a video of these items is also a good way to capture them just in case you need to revisit them for insurance or auditing purposes in the future. Items like jewelry, computers, art, and electronics are a good starting point.